31 Jul From Burnout to Breakthrough: Inside Project Neptune’s Strategic Exit with Revenue Rocket

“We built it to a point that there’s real, solid value … now it’s time for the next chapter.” – Project Neptune Co‑Founder

Project Neptune, a Managed Service Provider (MSP) based in the rapidly growing Northern Nevada market, just closed a sell‑side transaction with the guidance of Revenue Rocket. Below is the story behind the deal—what motivated the founders, how the process unfolded, and the biggest takeaways for MSP owners who might be eyeing their own breakthrough moment.

Quick Stats about Project Neptune

2024 Revenue: $2.6M

Adjusted EBITDA: $821 K (≈ 32% margin)

Recurring Revenue: 70 %

Headcount: 8 employees

Tech: Infrastructure managed services, cloud, networking & security

Customer Focus: Gaming, healthcare, & hospitality

The Inflection Point: When Growth Meets Burnout

For years Project Neptune’s husband‑and‑wife founding team enjoyed steady 30% year‑over‑year growth and enviable profitability. But scaling further required fresh capital, deeper bench strength, and most importantly, more hours than they had to give. Rather than risk plateauing (or burning out), they opted to sell in to a larger platform while rolling a portion of equity forward.

Why it mattered: Staying on with the acquirer lets the founders keep steering the ship while de‑risking personally and gaining the resources needed for the next growth curve.

Choosing the Right Co‑Pilot

Selling an MSP isn’t just about finding a buyer; it’s about orchestrating a competitive process that keeps leverage on your side. Before signing an engagement letter, Project Neptune’s founders spoke with boutique brokers, regional CPA firms, and solo “deal coaches.” Most either lacked deep MSP domain expertise or a recent track record of closed transactions. The founders quickly realized they needed more than a paperwork shuffler; they needed a strategic co-pilot who could refine their story, surface the right buyers, and safeguard value through diligence. That search led them to Revenue Rocket.

Project Neptune’s founder whittled a long list of roughly 20 advisors down to two, and recalls: “Revenue Rocket just knew the MSP space better than anyone else and came with the full team to handle diligence, marketing, and financial modeling.”

This depth of sector expertise and a proven record of closed MSP deals gave the founders confidence that Revenue Rocket could run a genuinely competitive process. At the same time, they stayed focused on the business instead of dealing with the distractions of potential suitors.

- Domain expertise. 100% focus on tech‑enabled services & MSP M&A.

- Deep buyer network. Ability to create real competition—not just field inbound calls.

- Full‑stack support. From valuation modeling and CIM creation to deal structuring and diligence defense.

Breaking Down the Go‑to‑Market Process

Selling a business is as much about preparation as it is about persuasion. Once the decision to move forward was made, Revenue Rocket guided Neptune through a tightly managed go-to-market sequence designed to position the company at its best, attract the right buyers, and create competitive tension that drove value.

- Packaging the story: Revenue Rocket scrubbed the financials, crafted a compelling teaser & CIM, and aligned on the founders’ “number.”

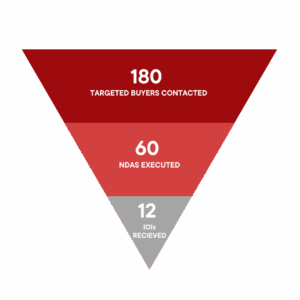

- Creating the funnel: Contacted 180 targeted buyers, secured 60 NDAs, and received 12 initial offers (IOIs) before moving into LOIs.

- Driving competition: Multiple rounds of Q&A and management calls whittled the field to the best strategic, cultural, and financial fit.

- Structuring the win‑win: The chosen LOI blended a strong cash component with an equity roll and performance earn‑out, maximizing up‑front value and future upside.

Deal Structure at a Glance

| Component | % of Total Consideration | Why It Matters |

|---|---|---|

| Cash at Close | Majority | “Chips off the table” security for the founders |

| Equity Roll | Meaningful minority | Aligns interests & shares in blended entity growth |

| Earn‑Out | Performance‑based | Rewards continued excellence & client retention |

What Made Project Neptune Stand Out?

In the podcast, Revenue Rocket CEO Mike Harvath walks through the exercise he and the founders completed to surface—and prove—Neptune’s strongest selling points. Rather than relying on gut‑feel, each differentiator was backed by data the deal team could drop straight into the Confidential Information Memorandum (CIM) and buyer Q&A. Highlights included:

- Clean, audit-ready financials: Revenue Rocket re-cast Neptune’s P&L by service line and normalized owner add-backs, turning messy books into diligence-ready statements and shaving weeks off buyer review.

- Predictable recurring revenue (70 % MRR): Neptune’s <3 % net churn and 38-month average contract terms, underscored the stability buyers crave.

- Regulatory moat: The founders led with their Nevada Gaming license and HIPAA-compliant processes, which are costly and time-consuming for competitors to replicate.

- Vertical & technical depth: certifications and skill were mapped to pipeline deals, showing how domain expertise translates directly into sales velocity and margin.

- Scalable delivery model : A hybrid U.S.–Philippines sales and support team provided round-the-clock coverage and operational flexibility without inflating overhead.

- Near-term growth pipeline: Reviewing signed SOWs, Revenue Rocket built a forward backlog projecting ~$1 M in additional ARR within 12 months, helping buyers see immediate upside.

- Strategic sale timing: Brought to market after a successful recovery from a revenue dip, with a healthy trendline and customer base to prove resilience.

- Owner self-awareness: The founders understood their bandwidth and risk tolerance, making them ideal partners for a buyer ready to invest in expansion.

- Competitive buyer environment:Our structured process attracted multiple qualified offers, creating leverage to secure favorable terms and structure.

- Flexible deal structure: Cash at close paired with an equity roll and performance-based earn-out aligned incentives and increased total potential return.

Lessons for MSP Owners Considering a Sale

“Don’t take the first offer. Find good advisors, surround yourself with smart people, and listen to them.” — Project Neptune C0-founder

Know your “next chapter” goal. Selling isn’t quitting; it’s reallocating risk and resources.

Get your house in order first. Accurate, timely financials can add turns to your EBITDA multiple.

Run the right process for your situation: Some owners benefit from casting a wide net to create competition. Others find the best fit with one highly motivated, strategically aligned buyer. The key is knowing which approach will maximize value for your goals.

Stay focused on the business during diligence. Let your advisor field the noise so revenue doesn’t slip.

Structure matters as much as price. Balance cash, equity, and earn‑out to fit your personal risk profile.

Prepare your team and clients for transition. Communicate to the right people at the right time, outline continuity plans, and mitigate any customer churn risk.

Ready to Explore your Options?

Whether you’re years away or already fielding buyer calls, Revenue Rocket can help you understand valuation, prep the company, and run a competitive process. Schedule a confidential conversation today, or hear the full podcast episode >>